Real Estate Investors

MSI provides investors in residential properties with specialized coverage options available through independent agents

Real Estate Investors

MSI provides investors in residential properties with specialized coverage options available through independent agents

Real Estate Investors

MSI provides investors in residential properties with specialized coverage options available through independent agents

MSI offers a hybrid personal-commercial policy for single-family home investors

MSI’s Real Estate Investor product combines homeowners and commercial general liability coverage options designed for investors with 1 to 500 residential properties that are rentals or in limited renovation for later rental or sale. For each property, limits of up to $1 million per occurrence for both property and liability are available in 49 states and D.C., backed by reputable, highly rated insurers.

Our technology delivers rapid quotes

With our industry-leading online portal, agents can easily submit applications, and our built-in advanced data provides quick feedback on whether a home qualifies and can often produce a quote within minutes. If further review is needed, our experienced underwriters are empowered with technology tools to quickly prepare customized coverage quotes, usually within one business day.

We deliver exceptional service to both agents and customers through every phase of the policy. In the event of a covered loss, our dedicated claims team has deep expertise with homes of every value, enabling them to help restore customers’ homes and contents as quickly as possible.

Let MSI show you how our combination of insurance know-how and advanced technology can make it easy to deliver a piece of mind to your residential real estate investor customers.

MSI offers a hybrid personal-commercial policy for single-family home investors

MSI’s Real Estate Investor product combines homeowners and commercial general liability coverage options designed for investors with 1 to 500 residential properties that are rentals or in limited renovation for later rental or sale. For each property, limits of up to $1 million per occurrence for both property and liability are available in 49 states and D.C., backed by reputable, highly rated insurers.

Our technology delivers rapid quotes

With our industry-leading online portal, agents can easily submit applications, and our built-in advanced data provides quick feedback on whether a home qualifies and can often produce a quote within minutes. If further review is needed, our experienced underwriters are empowered with technology tools to quickly prepare customized coverage quotes, usually within one business day.

We deliver exceptional service to both agents and customers through every phase of the policy. In the event of a covered loss, our dedicated claims team has deep expertise with homes of every value, enabling them to help restore customers’ homes and contents as quickly as possible.

Let MSI show you how our combination of insurance know-how and advanced technology can make it easy to deliver a piece of mind to your residential real estate investor customers.

MSI offers a hybrid personal-commercial policy for single-family home investors

MSI’s Real Estate Investor product combines homeowners and commercial general liability coverage options designed for investors with 1 to 500 residential properties that are rentals or in limited renovation for later rental or sale. For each property, limits of up to $1 million per occurrence for both property and liability are available in 49 states and D.C., backed by reputable, highly rated insurers.

Our technology delivers rapid quotes

With our industry-leading online portal, agents can easily submit applications, and our built-in advanced data provides quick feedback on whether a home qualifies and can often produce a quote within minutes. If further review is needed, our experienced underwriters are empowered with technology tools to quickly prepare customized coverage quotes, usually within one business day.

We deliver exceptional service to both agents and customers through every phase of the policy. In the event of a covered loss, our dedicated claims team has deep expertise with homes of every value, enabling them to help restore customers’ homes and contents as quickly as possible.

Let MSI show you how our combination of insurance know-how and advanced technology can make it easy to deliver a piece of mind to your residential real estate investor customers.

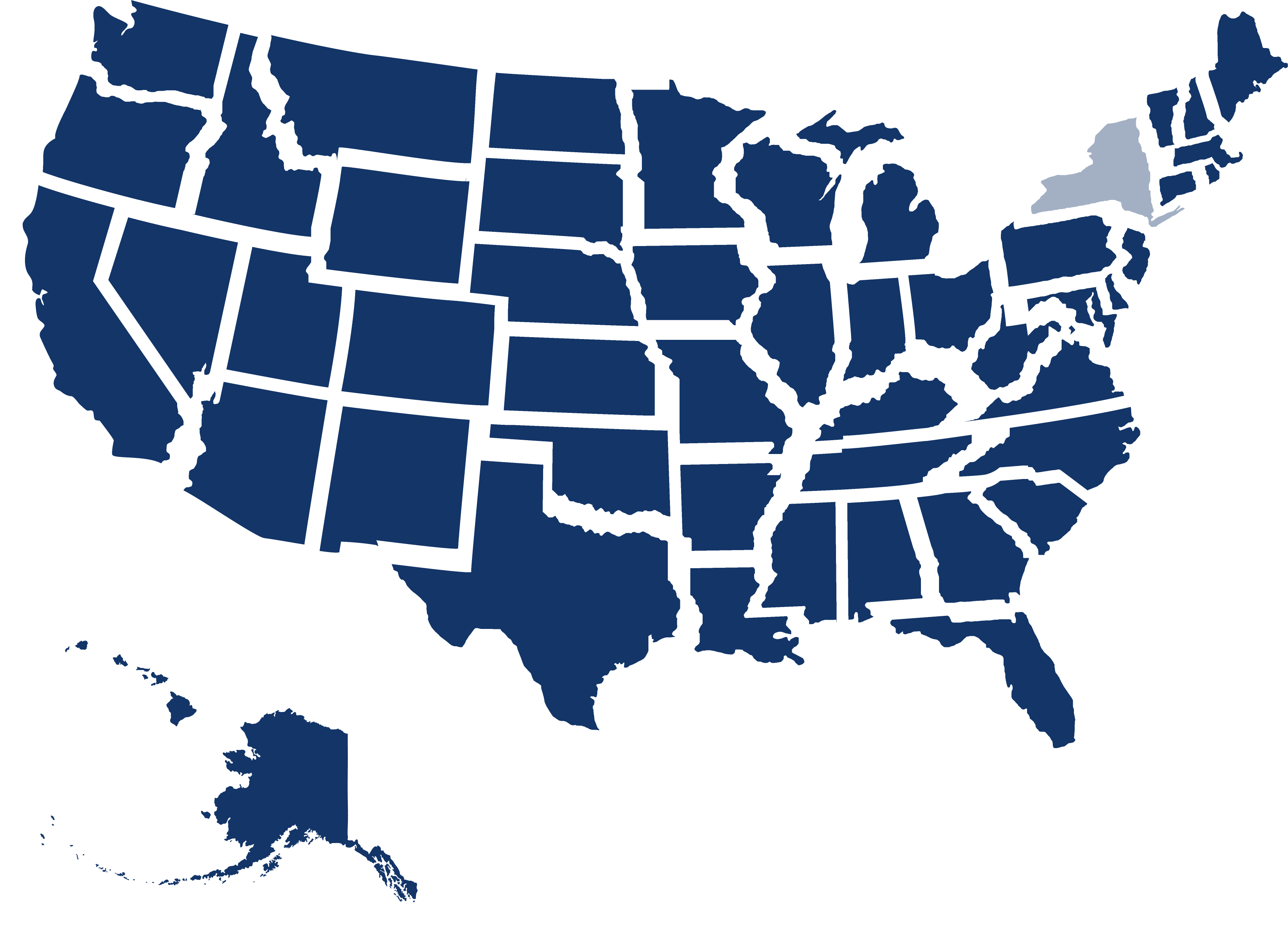

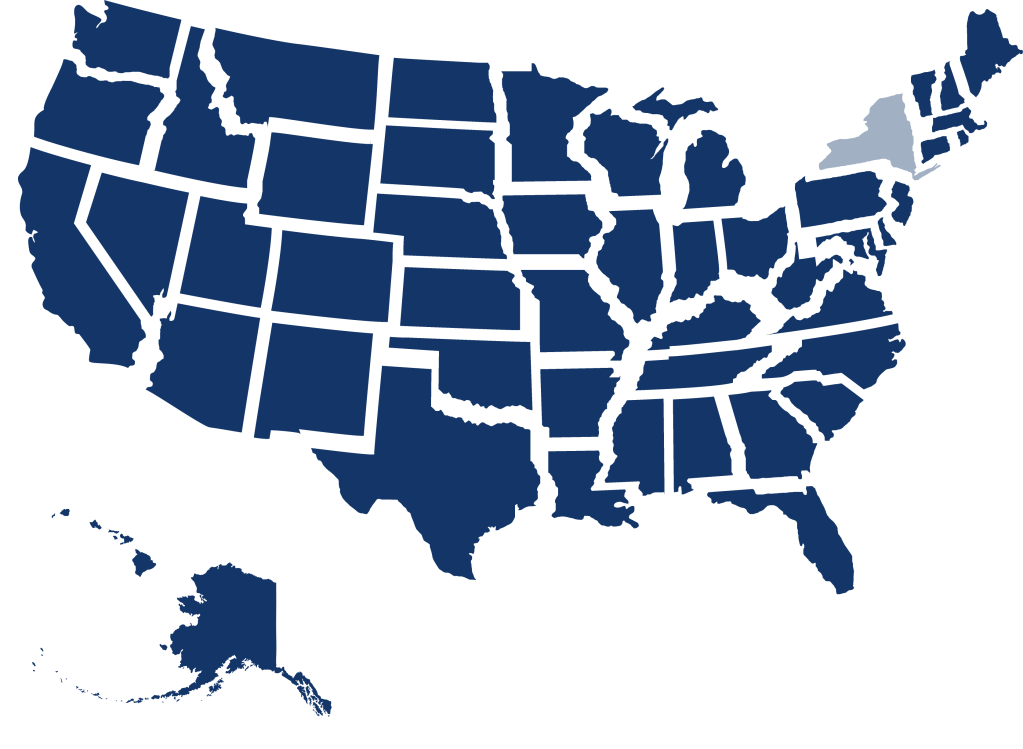

Availability

- Nationwide except New York

Coverage

- Property: Up to $1 million

- Liability: Up to $1 million per occurrence, $2 million annual aggregate

- Several deductible options up to $50,000 for All Other Perils and up to 10% for Wind or Hail

- Ability to cover properties in the name of an LLC or trust

Service highlights

- Simplified, fast underwriting

- All locations owned can be insured on a single policy*

- Pay for what you use, no minimum premium

- Easy autopay options – ACH, credit card and escrow

- Electronic billing and evidence of insurance

*Subject to underwriting eligibility

Eligibility

- Non-owner-occupied single-family houses, townhomes and condos (up to four units)

- Rental, vacant and limited renovation properties

Partners integrating MSI’s tech platform

Why MSI?

Why MSI?

Contact Us

"*" indicates required fields