Commercial General Liability

MSI collaborates with select brokers and leading insurers to protect you and your business from general claims involving bodily injury and property damage

Commercial General Liability

MSI collaborates with select brokers and leading insurers to protect you and your business from general claims involving bodily injury and property damage

Commercial General Liability

MSI collaborates with select brokers and leading insurers to protect you and your business from general claims involving bodily injury and property damage

Taking the guesswork out of commercial general liability

Commercial general liability (CGL) can help cover claims, medical expenses, and attorney fees resulting from bodily injury and property damage caused by your products, services, or operations.

Most insurance claims affecting commercial residential buildings such as apartments, condominiums, and other multi-family complexes were caused by slip-and-fall and capacity was widely available. Over the years, habitational became one of the cornerstone lines in casualty. After all, habitational is a $22 billion segment representing 7% of the more than $300 billion commercial lines market.

However, habitational has become a challenging class due to new types of risks, broader claims, and an overall lack of capacity. The rise in various types of claims, including assault and battery, habitability, and human trafficking, means the habitational sector continues to be a challenge for insurers.

Proven experience and customized coverage for your unique risks

At MSI, we specialize in tackling hard-to-place risks. We leverage our deep underwriting experience and flexible approach to design programs that align with clients’ risk management strategies and budgets. Utilizing ISO forms, endorsements, and select manuscript endorsements, we provide options to help you tailor coverage to meet the unique needs of each insured. Our programs can be customized by including or excluding specific coverages and adjusting deductible levels as needed.

We are backed by an A+ rated carrier and dedicated to delivering outstanding service to brokers and clients throughout the policy lifecycle, expertly managing every aspect of the program, including underwriting, policy updates, and claims handling.

Taking the guesswork out of commercial general liability

Commercial general liability (CGL) can help cover claims, medical expenses, and attorney fees resulting from bodily injury and property damage caused by your products, services, or operations.

Most insurance claims affecting commercial residential buildings such as apartments, condominiums, and other multi-family complexes were caused by slip-and-fall and capacity was widely available. Over the years, habitational became one of the cornerstone lines in casualty. After all, habitational is a $22 billion segment representing 7% of the more than $300 billion commercial lines market.

However, habitational has become a challenging class due to new types of risks, broader claims, and an overall lack of capacity. The rise in various types of claims, including assault and battery, habitability, and human trafficking, means the habitational sector continues to be a challenge for insurers.

Proven experience and customized coverage for your unique risks

At MSI, we specialize in tackling hard-to-place risks. We leverage our deep underwriting experience and flexible approach to design programs that align with clients’ risk management strategies and budgets. Utilizing ISO forms, endorsements, and select manuscript endorsements, we provide options to help you tailor coverage to meet the unique needs of each insured. Our programs can be customized by including or excluding specific coverages and adjusting deductible levels as needed.

We are backed by an A+ rated carrier and dedicated to delivering outstanding service to brokers and clients throughout the policy lifecycle, expertly managing every aspect of the program, including underwriting, policy updates, and claims handling.

Taking the guesswork out of commercial general liability

Commercial general liability (CGL) can help cover claims, medical expenses, and attorney fees resulting from bodily injury and property damage caused by your products, services, or operations.

Most insurance claims affecting commercial residential buildings such as apartments, condominiums, and other multi-family complexes were caused by slip-and-fall and capacity was widely available. Over the years, habitational became one of the cornerstone lines in casualty. After all, habitational is a $22 billion segment representing 7% of the more than $300 billion commercial lines market.

However, habitational has become a challenging class due to new types of risks, broader claims, and an overall lack of capacity. The rise in various types of claims, including assault and battery, habitability, and human trafficking, means the habitational sector continues to be a challenge for insurers.

Proven experience and customized coverage for your unique risks

At MSI, we specialize in tackling hard-to-place risks. We leverage our deep underwriting experience and flexible approach to design programs that align with clients’ risk management strategies and budgets. Utilizing ISO forms, endorsements, and select manuscript endorsements, we provide options to help you tailor coverage to meet the unique needs of each insured. Our programs can be customized by including or excluding specific coverages and adjusting deductible levels as needed.

We are backed by an A+ rated carrier and dedicated to delivering outstanding service to brokers and clients throughout the policy lifecycle, expertly managing every aspect of the program, including underwriting, policy updates, and claims handling.

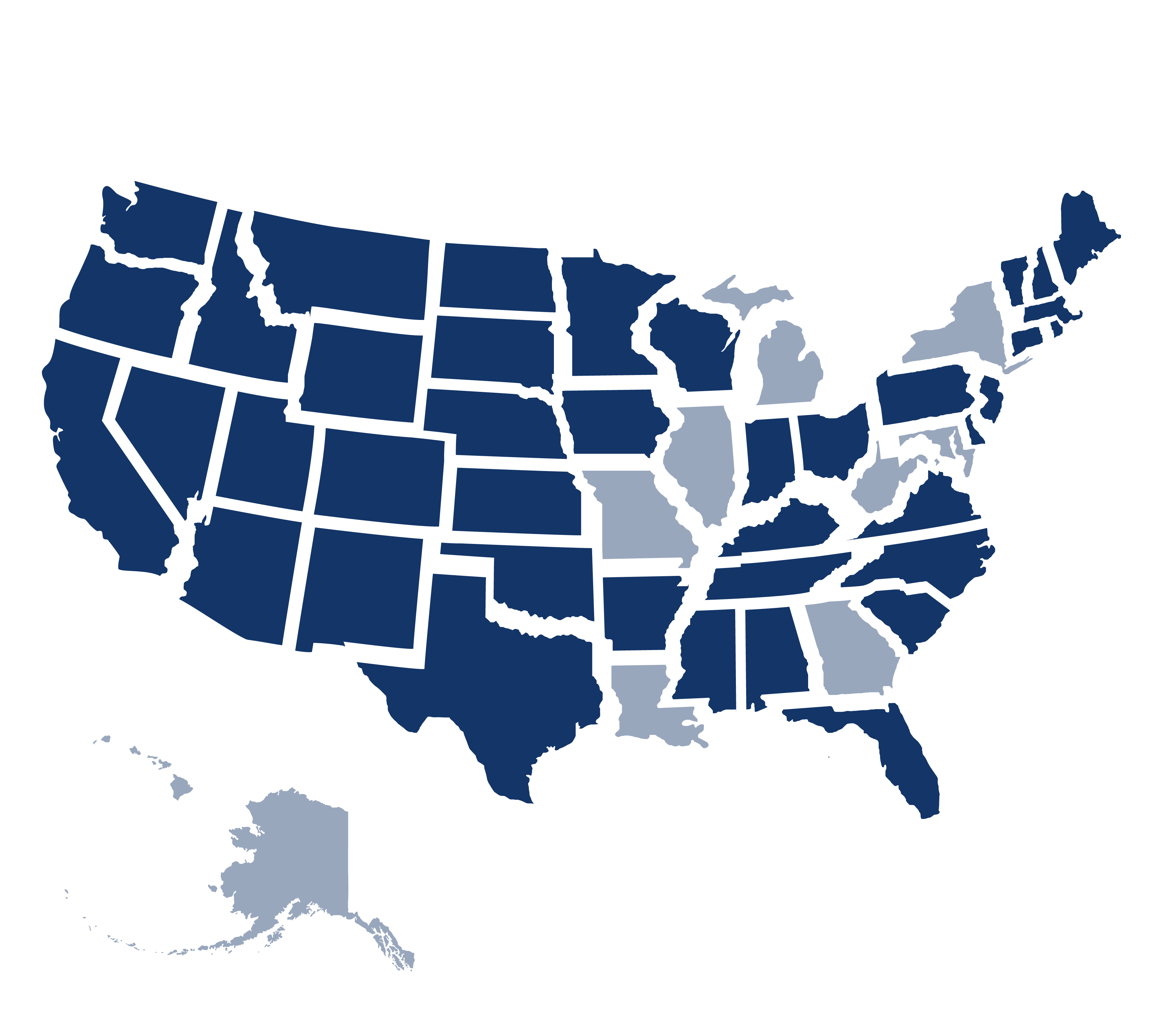

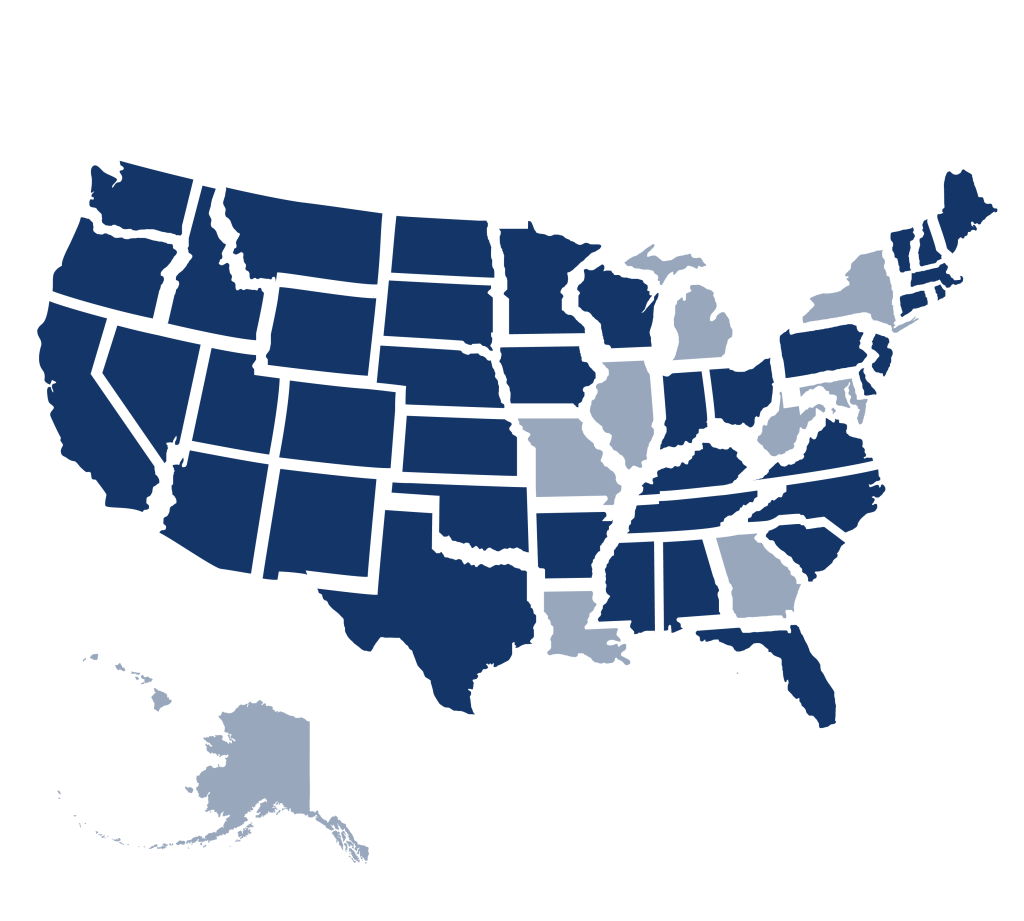

Availability

- Nationwide except the following states and counties:

- Hawaii

- Alaska

- New York

- Georgia

- West Virginia

- Louisiana

- Louis, MO

- Cook County, IL

- Lansing, MI

- Baltimore, MD

Coverage

- Commercial general liability utilizing the 2014 edition ISO form

- $1 million per occurrence, $2 million aggregate

- Hired and non-owned auto, $500,000 to $1 million options

- Personal and advertising injury

- Products and completed operations (available upon request)

- Assault and battery (including sexual misconduct), up to $1 million where available

- Employee benefits liability $1 million (available upon request)

- Deductibles from $1,000 to $25,000 will be used to mitigate risk and will be sufficient in most cases

Eligibility

- Apartments

- Condominiums and townhomes

- Homeowners associations

- Dwelling (one to four families)

- Incidental commercial space

Partners integrating MSI’s tech platform

Why MSI?

Why MSI?

Contact Us

"*" indicates required fields