Flood

MSI makes it easy for agents to provide commercial customers with broad protection against one of the most prevalent property risks

Flood

MSI makes it easy for agents to provide commercial customers with broad protection against one of the most prevalent property risks

Flood

MSI makes it easy for agents to provide commercial customers with broad protection against one of the most prevalent property risks

MSI takes flood coverage to a new level for businesses

Flooding risk is widespread in America, with 99% of counties having flooded at least once, according to the Federal Emergency Management Agency. However, many commercial package policies don’t include flood coverage, leaving businesses vulnerable.

MSI has developed a commercial flood insurance program that offers a $1.25 million combined limit for building and contents, providing more coverage and flexibility than the National Flood Insurance Program’s (NFIP) $500,000 limits for each. MSI also offers an industry-first $10,000 coverall endorsement that fills common coverage gaps, such as business interruption and cost of restoring power.

Our coverage takes effect within five days

MSI’s program also addresses other pain points with the NFIP, including its 30-day coverage waiting period – MSI’s coverage takes effect within five days – and its extensive documentation requirements. MSI provides agents with its industry-leading technology that streamlines the submission process and empowers them to quote and bind coverage in minutes. And our commission is competitive with the NFIP and attractive compared to other private-market programs. In the event of a flooding loss, agents and customers can rest assured that our experienced, dedicated claims team will work diligently to restore the property and contents quickly.

Let MSI show you how easy it can be to provide valuable flood protection to your business customers.

MSI takes flood coverage to a new level for businesses

Flooding risk is widespread in America, with 99% of counties having flooded at least once, according to the Federal Emergency Management Agency. However, many commercial package policies don’t include flood coverage, leaving businesses vulnerable.

MSI has developed a commercial flood insurance program that offers a $1.25 million combined limit for building and contents, providing more coverage and flexibility than the National Flood Insurance Program’s (NFIP) $500,000 limits for each. MSI also offers an industry-first $10,000 coverall endorsement that fills common coverage gaps, such as business interruption and cost of restoring power.

Our coverage takes effect within five days

MSI’s program also addresses other pain points with the NFIP, including its 30-day coverage waiting period – MSI’s coverage takes effect within five days – and its extensive documentation requirements. MSI provides agents with its industry-leading technology that streamlines the submission process and empowers them to quote and bind coverage in minutes. And our commission is competitive with the NFIP and attractive compared to other private-market programs. In the event of a flooding loss, agents and customers can rest assured that our experienced, dedicated claims team will work diligently to restore the property and contents quickly.

Let MSI show you how easy it can be to provide valuable flood protection to your business customers.

MSI takes flood coverage to a new level for businesses

Flooding risk is widespread in America, with 99% of counties having flooded at least once, leaving businesses vulnerable.

MSI offers a commercial flood insurance program with a $1.25 million combined limit for building and contents, providing more coverage and flexibility than the National Flood Insurance Program (NFIP). MSI also provides an industry-first $10,000 coverall endorsement that fills coverage gaps, such as business interruption.

Our coverage takes effect within five days

MSI’s coverage takes effect within a week, compared to 30 days for the NFIP. Our industry-leading technology streamlines the submission process and empowers agents to quote and bind coverage in minutes. And our commission is attractive compared to other private-market programs. If a flooding loss occurs, our experienced claims team will work diligently to restore the property and contents.

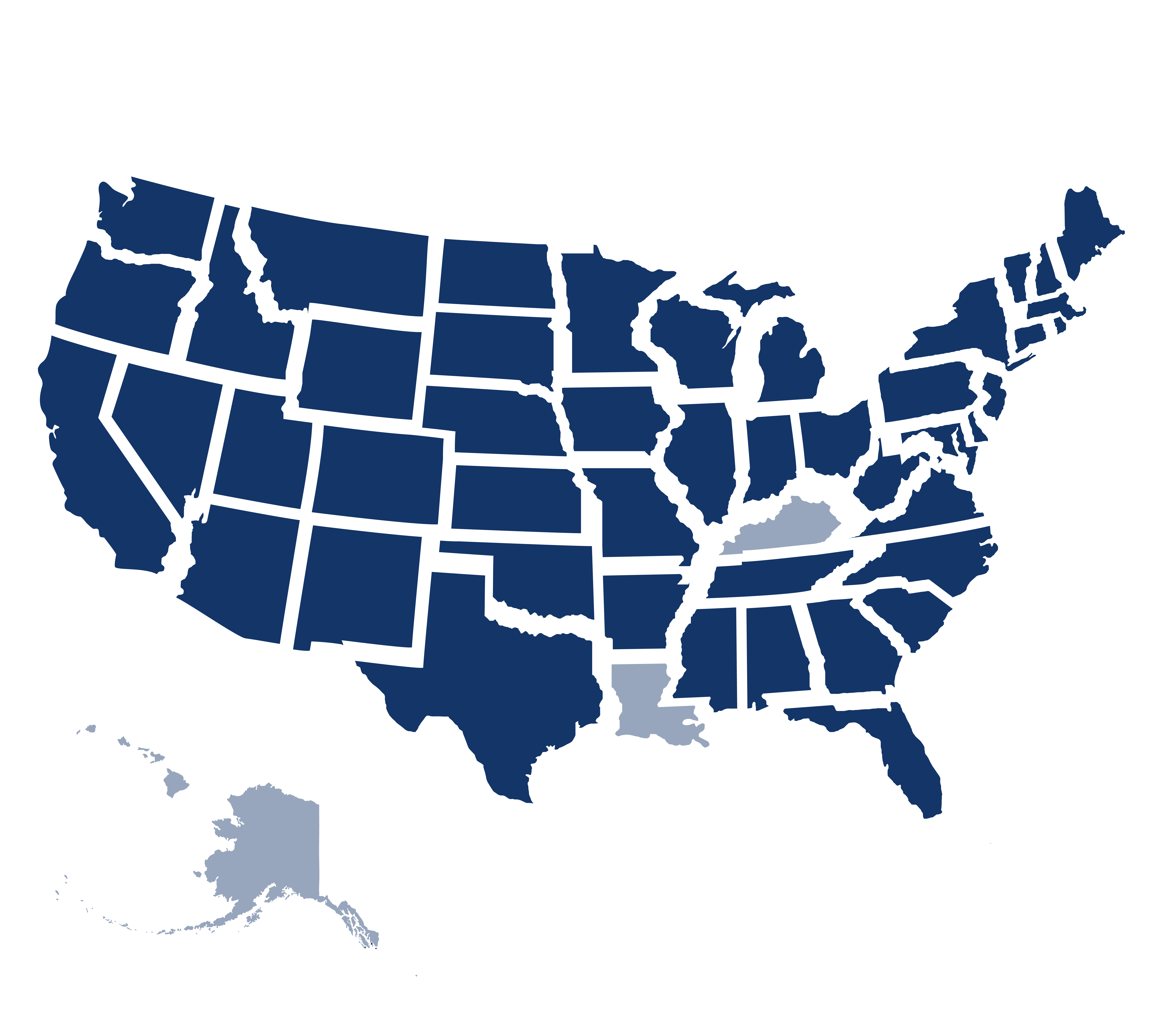

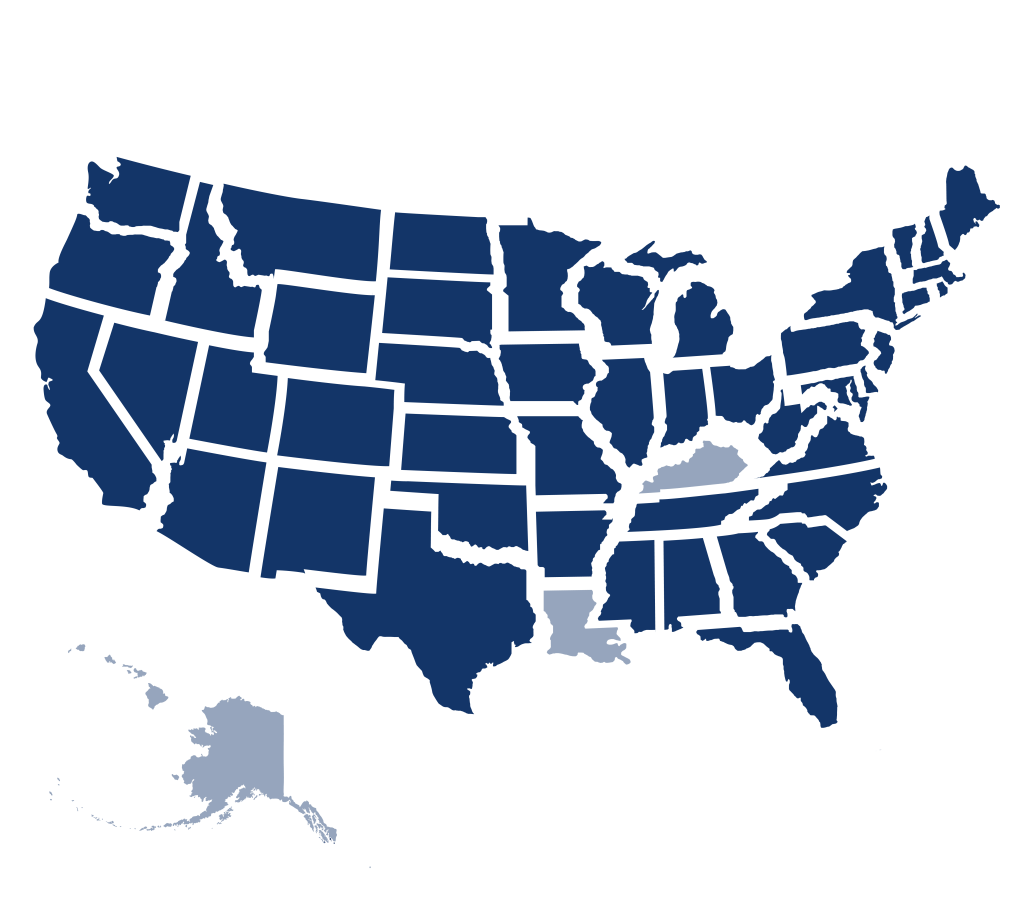

Availability

- Nationwide except for Alaska, Hawaii, Kentucky, and Louisiana

Coverage

- Combined Building and Contents Limit: Up to $1.25 million (compared to NFIP’s $500,000 for building and $500,000 for contents)

- Deductibles: $1,000 to $10,000

- Backed by highly-rated insurers

- Waiting period: 5-7 days (vs. 30 days for NFIP)

Program Highlights

- Broader coverage and shorter waiting period than NFIP

- Innovative, industry-first gap coverage endorsement

- Replacement Cost Value loss settlement option

- No elevation certificates or appraisals required

- High resolution data and use of technology make quoting and binding easier

- Industry-leading customer service

Eligibility

- Exclusions include barrier islands, manufactured structures, two or more previous flood losses, and more

Partners integrating MSI’s tech platform

Why MSI?

Why MSI?

Contact Us

"*" indicates required fields