Flood Insurance

MSI provides agents with technology tools to help homeowners protect against the most common cause of property loss

Flood Insurance

MSI provides agents with technology tools to help homeowners protect against the most common cause of property loss

Flood Insurance

MSI provides agents with technology tools to help homeowners protect against the most common cause of property loss

Combining superior coverage with simple, super-fast delivery

Homeowner’s policies don’t cover damage from external flooding¹, not because the risk is low, but because it is so prevalent. Flooding produces the highest frequency and highest severity losses for homeowners, and while lenders require flood coverage in higher-risk areas, 40% of losses occur outside these zones².

MSI’s flood insurance solution offers far higher limits and broader coverage than the National Flood Insurance Program (NFIP), providing up to $2 million of building coverage and $500,000 for contents, backed by highly-rated insurers. MSI also offers an industry-first $10,000 coverall endorsement that can be used for any interim needs until repairs are made. And MSI’s coverage takes effect within a week, compared to the NFIP’s 30-day waiting period.

Our technology makes it simple to write coverage

The key to MSI’s flood program is an industry-leading technology that streamlines the submission process and empowers agents to quote and bind coverage in minutes. Our platform also makes it easy for agents to send an email to customers without existing flood coverage and encourage them to build their own quotes. In the event of a flooding loss, our experienced, dedicated claims team works to restore the home and contents quickly. To top it off, MSI’s commission is competitive with the NFIP and attractive compared to other private-market programs.

Give MSI an opportunity to show you how simple it can be to provide valuable flood protection to your homeowners customers.

Combining superior coverage with simple, super-fast delivery

Homeowner’s policies don’t cover damage from external flooding¹, not because the risk is low, but because it is so prevalent. Flooding produces the highest frequency and highest severity losses for homeowners, and while lenders require flood coverage in higher-risk areas, 40% of losses occur outside these zones².

MSI’s flood insurance solution offers far higher limits and broader coverage than the National Flood Insurance Program (NFIP), providing up to $2 million of building coverage and $500,000 for contents, backed by highly-rated insurers. MSI also offers an industry-first $10,000 coverall endorsement that can be used for any interim needs until repairs are made. And MSI’s coverage takes effect within a week, compared to the NFIP’s 30-day waiting period.

Our technology makes it simple to write coverage

The key to MSI’s flood program is industry-leading technology that streamlines the submission process and empowers agents to quote and bind coverage in minutes. Our platform also makes it easy for agents to send an email to customers without existing flood coverage and encourage them to build their own quotes. In the event of a flooding loss, our experienced, dedicated claims team works to restore the home and contents quickly. To top it off, MSI’s commission is competitive with the NFIP and attractive compared to other private-market programs.

Give MSI an opportunity to show you how simple it can be to provide valuable flood protection to your homeowners customers.

Combining superior coverage with simple, super-fast delivery

Homeowners policies don’t cover damage from external flooding¹, not because the risk is low, but because it is so prevalent.

MSI’s flood insurance solution offers far higher limits and broader coverage than the National Flood Insurance Program (NFIP), providing up to $2 million of building coverage and $500,000 for contents. MSI also offers an industry-first $10,000 coverall endorsement that can be used for any interim needs. And MSI’s coverage takes effect within a week, compared to 30 days for the NFIP.

Our technology makes it simple to write coverage

MSI’s industry-leading technology streamlines the submission process and empowers agents to quote and bind coverage in minutes. If a flooding loss occurs, our experienced, dedicated claims team works to restore the home and contents quickly. And MSI’s commission is attractive compared to other private-market programs.

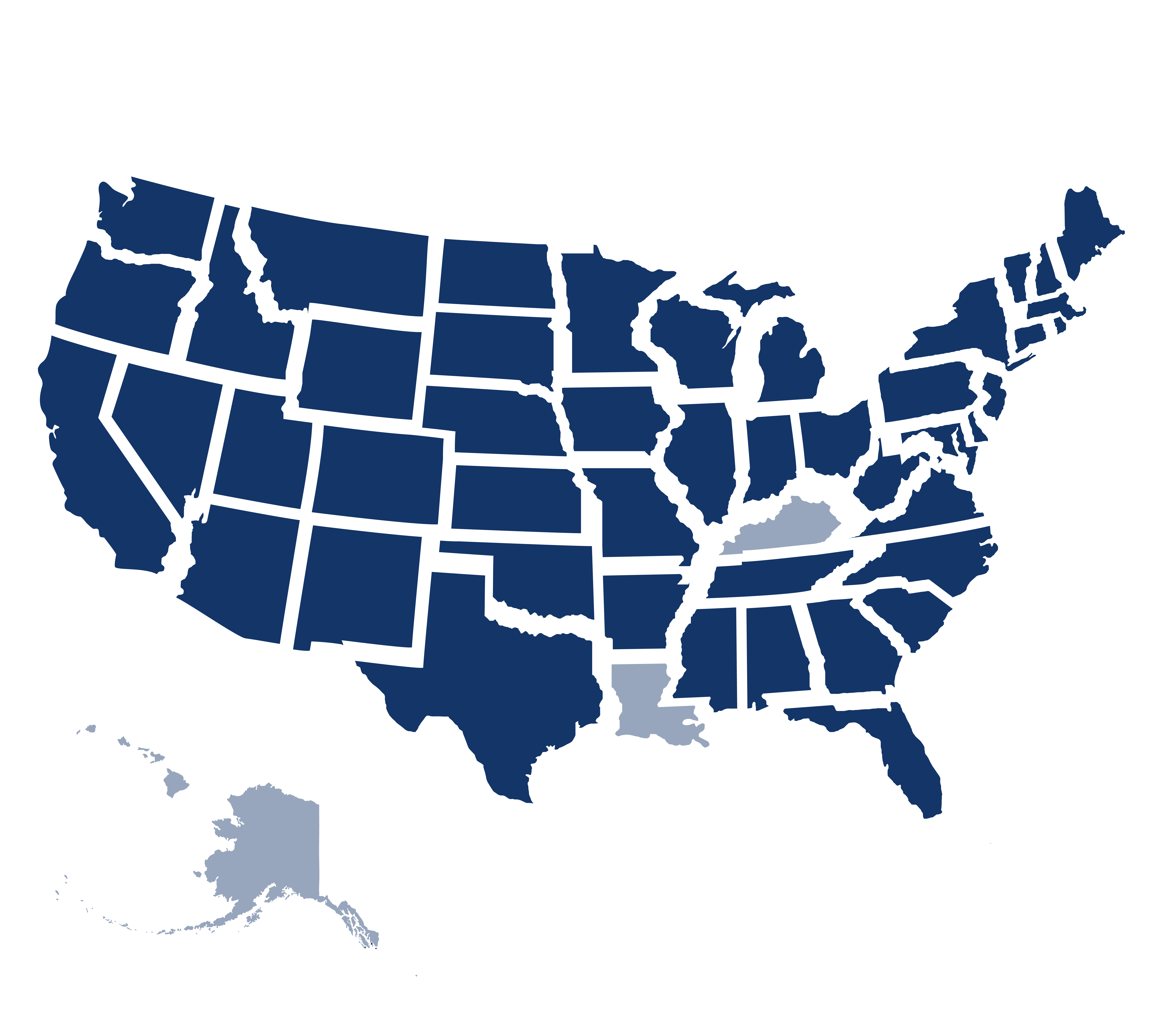

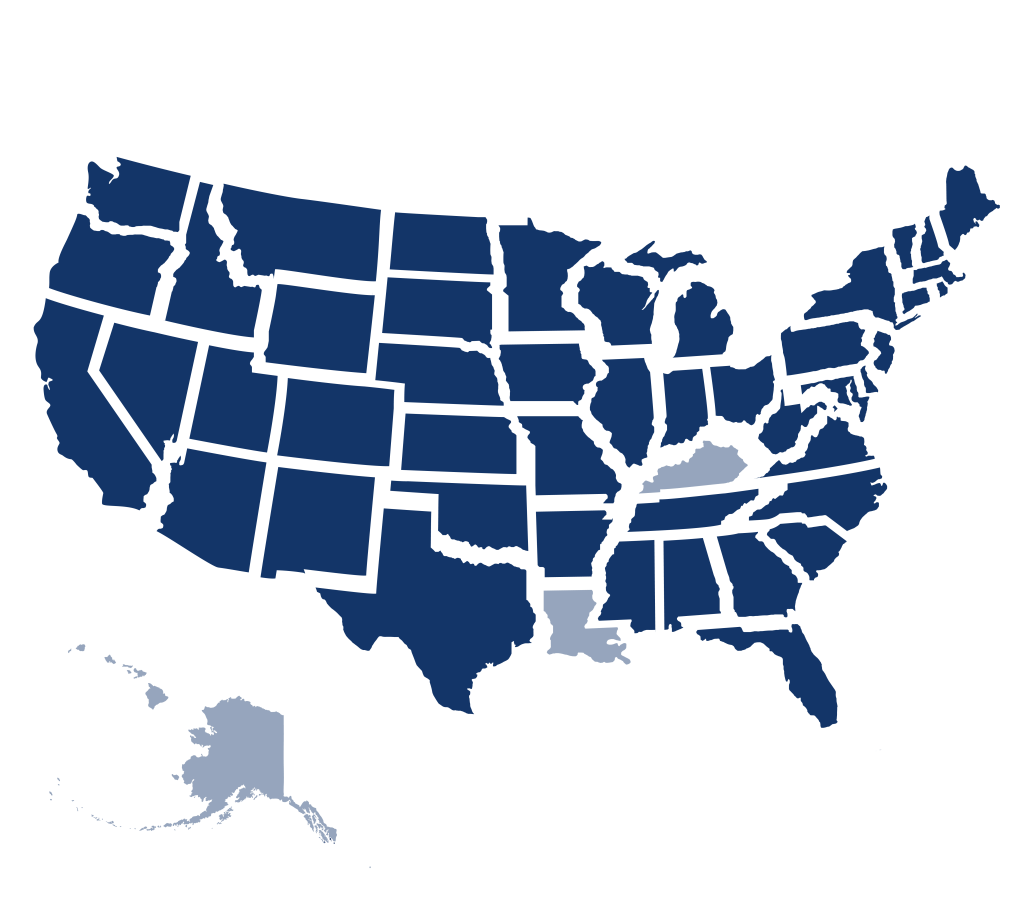

Availability

- All states excluding Louisiana, Alaska, Kentucky, and Hawaii

Coverage

- Building: Up to $2 million (vs. $250,000 for NFIP)

- Contents: Up to $1.3 million (vs. $100,000 for NFIP)

- Deductibles: $1,000 to $10,000

- Waiting period: 5-7 days (vs. 30 days for NFIP)

Program Highlights

- No elevation certificates or appraisals required

- High resolution data within our technology makes quoting and binding easier

- Competitive rates – on average 10% more cost effective than NFIP

- Industry-leading customer service

Eligibility

Exclusions for barrier islands, manufactured homes, two or more previous flood losses, and more

Partners integrating MSI’s tech platform

Why MSI?

Why MSI?

Contact Us

"*" indicates required fields