Habitational Property

MSI partners with select brokers and leading insurers to provide much-needed property risk capacity for apartments, condos, co-ops and similar properties

Habitational Property

MSI partners with select brokers and leading insurers to provide much-needed property risk capacity for apartments, condos, co-ops and similar properties

Habitational Property

MSI partners with select brokers and leading insurers to provide much-needed property risk capacity for apartments, condos, co-ops and similar properties

Solving the insurance access challenge for habitational property owners

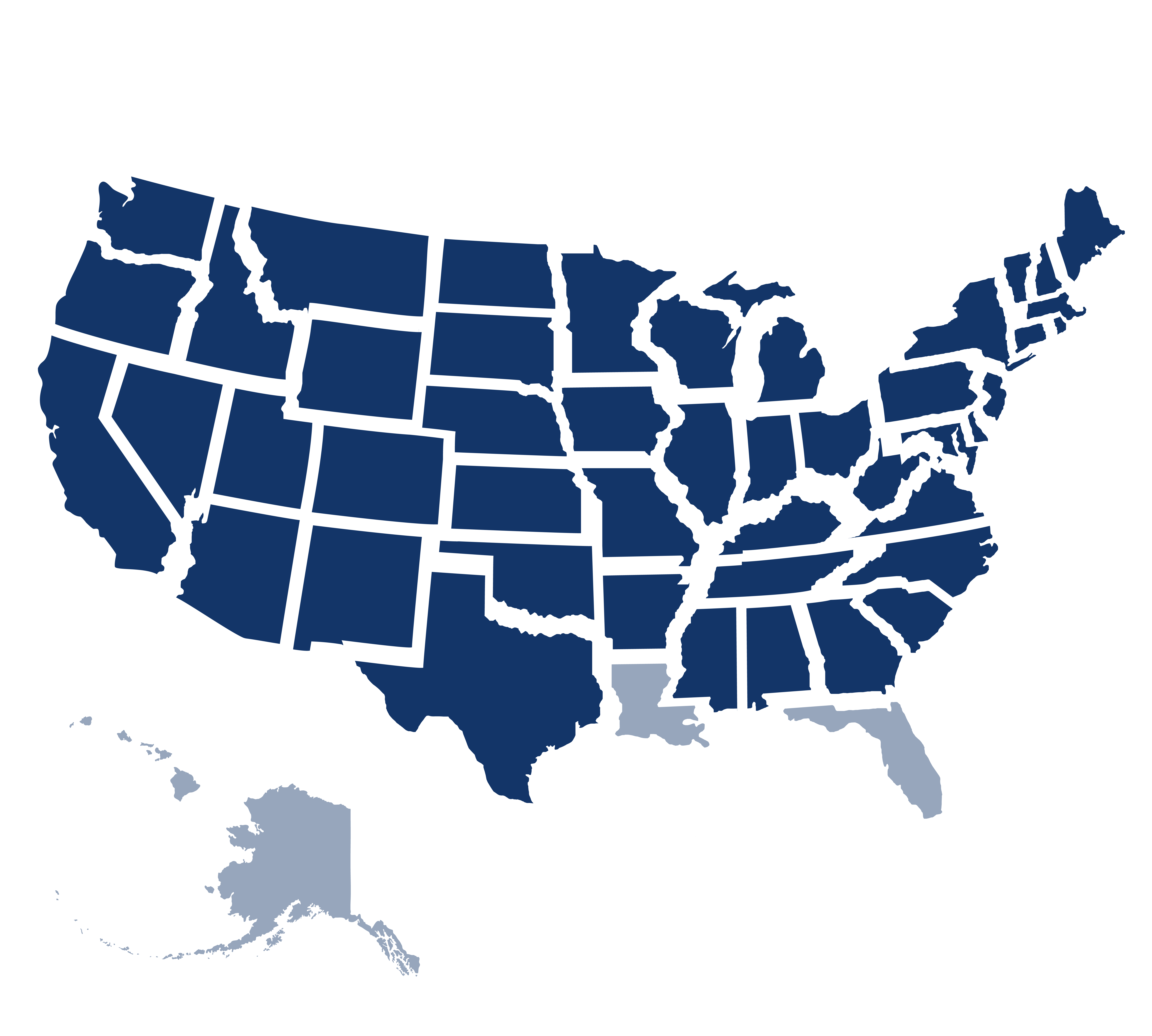

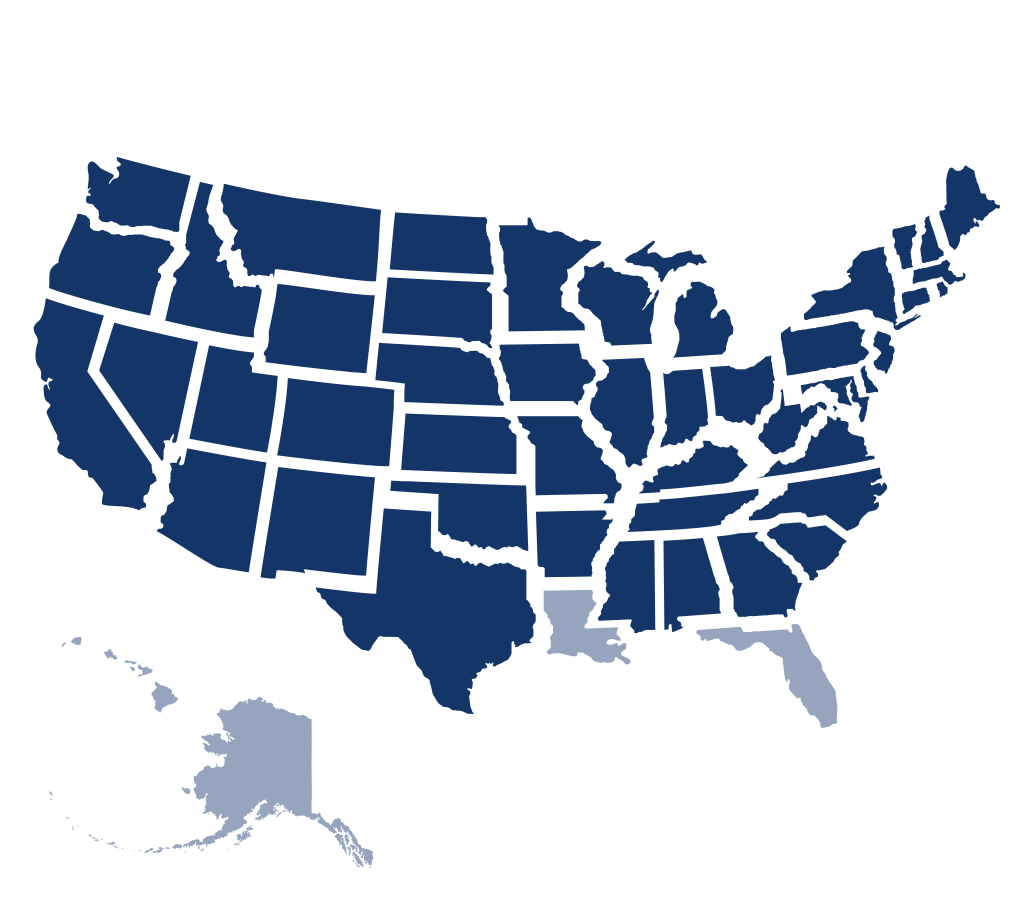

Habitational properties, especially more than 30 years old, have seen a reduction in risk capacity in recent years. To address this need, MSI has developed a property program, backed by a major global insurer and reinsurers, that offers two options – up to $35 million of ground up coverage, or $5 million primary layer limit coverage for properties with an insured value of $35 million to $50 million. This program is available in all states except Alaska and Hawaii.

Customized coverages for challenging risks

MSI doesn’t back away from harder-to-place risks like these, which require deep underwriting expertise and a flexible approach to structure programs that fit clients’ risk management strategies and budgets. MSI uses ISO forms and endorsements, but to meet specific needs we can customize the program by adding or excluding certain coverages, including select manuscript endorsements, and by adjusting deductible levels.

We provide exceptional service to brokers and clients throughout the policy lifecycle, managing all aspects of the program in-house, from underwriting to policy updates to claims handling by our expert team. Since reputable contractors are critical to rebuilding after a loss, in many states MSI features a Managed Repair program that leverages preferred contractors.

Solving the insurance access challenge for habitational

property owners

Habitational properties, especially more than 30 years old, have seen a reduction in risk capacity in recent years. To address this need, MSI has developed a property program, backed by a major global insurer and reinsurers, that offers two options – up to $35 million of ground up coverage, or $5 million primary layer limit coverage for properties with insured value of $35 million to $50 million. This program is available in all states except Alaska and Hawaii.

Customized coverages for challenging risks

MSI doesn’t back away from harder-to-place risks like these, which require deep underwriting expertise and a flexible approach to structure programs that fit clients’ risk management strategies and budgets. MSI uses ISO forms and endorsements, but to meet specific needs we can customize the program by adding or excluding certain coverages, including select manuscript endorsements, and by adjusting deductible levels.

We provide exceptional service to brokers and clients throughout the policy lifecycle, managing all aspects of the program in-house, from underwriting to policy updates to claims handling by our expert team. Since reputable contractors are critical to rebuilding after a loss, in many states MSI features a Managed Repair program that leverages preferred contractors.

Solving the insurance access challenge

for habitational property owners

Habitational properties have seen a reduction in risk capacity in recent years. To address this need, MSI offers a property program with two options – up to $35 million of ground up coverage, or $5 million primary layer limit coverage for properties with an insured value of $35 million to $50 million. This program is available in all states except Alaska and Hawaii.

Customized coverages for challenging risks

Harder-to-place risks like these require deep underwriting expertise and a flexible approach to structure programs that fit clients’ risk management strategies. MSI uses ISO forms and endorsements, but we can customize by adding or excluding certain coverages, including select manuscript endorsements, and by adjusting deductibles.

We provide exceptional service throughout the policy lifecycle, managing all aspects of the program in-house.

Availability

- Nationwide except Alaska and Hawaii

- Available in Florida and Louisiana excluding wind, including Tier 1 (ocean adjacent) and Tier 2 (inland adjacent to Tier 1) counties

Coverage

- Treaty Ground Up Limits Per Location – Up to $50 million per location (Blanket or Scheduled)

- Primary $5 million Layer Limits Per Location – for Properties with $35 million – $50 million Total Insured Value (Blanket)

- Maximum Per-Building Limit: $10 million

- Coverage includes building, business personal property, other structures, ordinance and law, and business income/extra expense/loss of rents

- Preferred coverages – Equipment breakdown and Terrorism Risk Insurance Act

- Managed Repair program featuring preferred contractors (where available)

Eligibility

Multi-unit:

- Apartments

- Condominiums

- Cooperative Apartments

- Similar Exposures

Preference for buildings constructed in 1980s and later

Partners integrating MSI’s tech platform

Why MSI?

Why MSI?

Contact Us

"*" indicates required fields