Coastal Homeowners Insurance

MSI provides home insurance in underserved, catastrophe exposed states along the Atlantic and Gulf coasts through independent agents

Coastal Homeowners Insurance

MSI provides home insurance in underserved, catastrophe exposed states along the Atlantic and Gulf coasts through independent agents

Coastal Homeowners Insurance

MSI provides home insurance in underserved, catastrophe exposed states along the Atlantic and Gulf coasts through independent agents

MSI solves the insurance challenge for homeowners in higher-risk areas

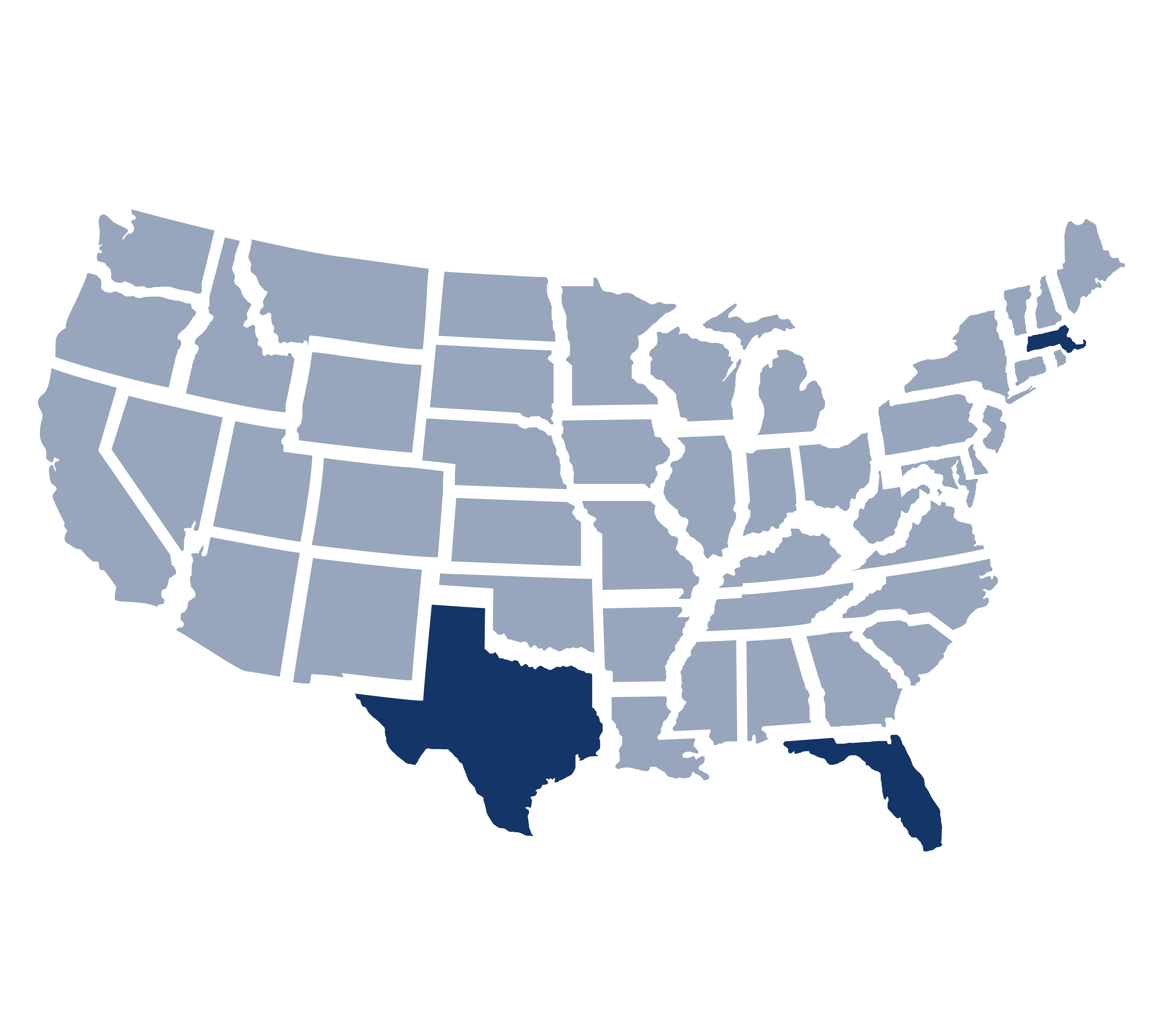

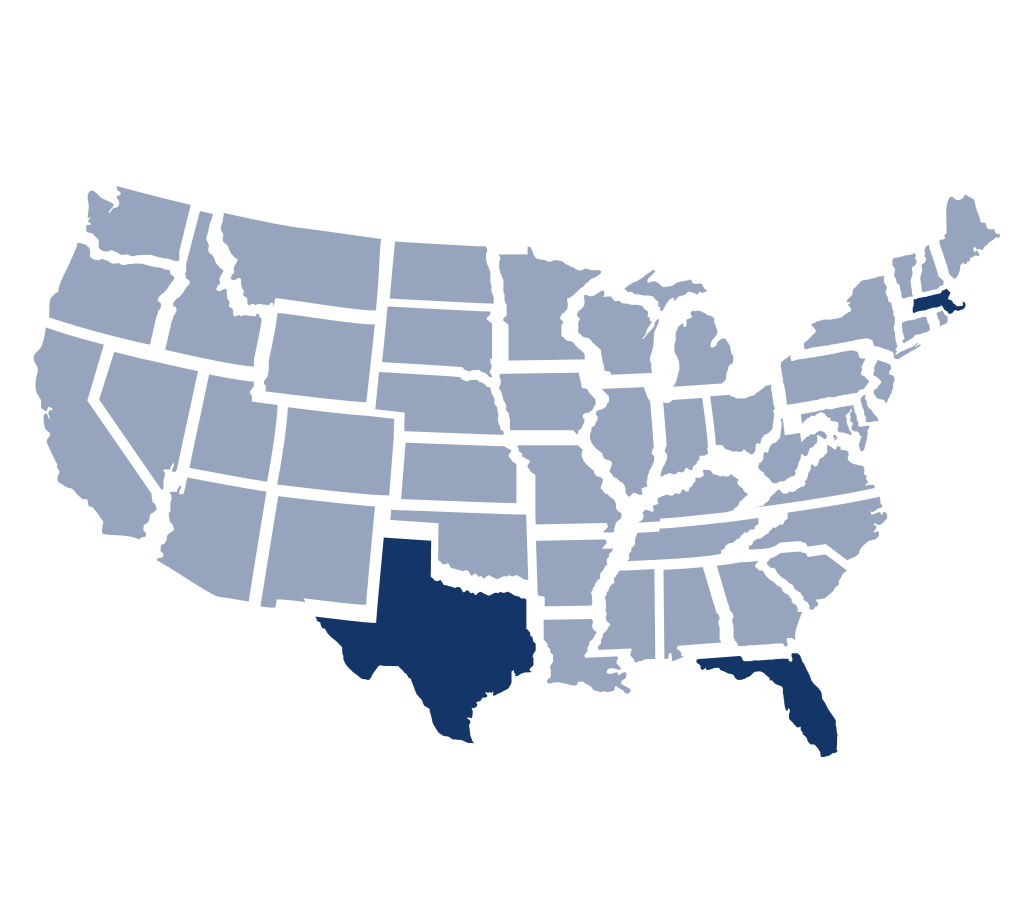

Homeowners in many coastal states are finding it increasingly difficult to secure coverage. MSI and its highly-rated insurance company partners are solving this challenge, providing reliable admitted HO3 coverage in states along the Atlantic and Gulf coasts, including Florida, Texas and Massachusetts, with more states to come.

MSI offers up to $1.5 million of dwelling coverage, varying by state, for single-family primary, secondary or rental homes. For high-quality properties, we won’t shy away from coastal and other areas with high catastrophe risk. We also provide flexible coverage options, including a wide range of deductible levels to help manage premiums.

MSI’s technology makes the application process quick and easy

We deliver responsive service during every phase of the policy. Our industry-leading online portal makes it easy for agents to submit applications, and its built-in third-party data and modeling capabilities often enable quotes in minutes. If further review is needed, our highly experienced underwriters use advanced technology tools to turn around customized quotes quickly, usually within 24 hours. In the event of a covered loss, our dedicated claims team has the deep expertise to resolve it promptly and fairly.

Let MSI show you how our homeowners insurance expertise and advanced technology make it easy to deliver peace of mind to your customers.

MSI solves the insurance challenge for homeowners in higher-risk areas

Homeowners in many coastal states are finding it increasingly difficult to secure coverage. MSI and its highly-rated insurance company partners are solving this challenge, providing reliable admitted HO3 coverage in states along the Atlantic and Gulf coasts, including Florida, Texas and Massachusetts, with more states to come.

MSI offers up to $1.5 million of dwelling coverage, varying by state, for single-family primary, secondary or rental homes. For high-quality properties, we won’t shy away from coastal and other areas with high catastrophe risk. We also provide flexible coverage options, including a wide range of deductible levels to help manage premiums.

MSI’s technology makes the application process quick and easy

We deliver responsive service during every phase of the policy. Our industry-leading online portal makes it easy for agents to submit applications, and its built-in third-party data and modeling capabilities often enable quotes in minutes. If further review is needed, our highly experienced underwriters use advanced technology tools to turn around customized quotes quickly, usually within 24 hours. In the event of a covered loss, our dedicated claims team has the deep expertise to resolve it promptly and fairly.

Let MSI show you how our homeowners insurance expertise and advanced technology make it easy to deliver peace of mind to your customers.

MSI solves the insurance challenge for homeowners in higher-risk areas

Homeowners in many coastal states are finding it harder to secure coverage. MSI and its insurance company partners are solving this challenge, providing admitted coverage in Atlantic and Gulf Coast states, including Florida, Texas, and Massachusetts, with more states to come.

MSI offers up to $1.5 million of dwelling coverage for single-family primary, secondary, or rental homes, including high-quality properties in higher-risk areas. We also provide flexible coverage and deductible options.

MSI’s technology makes the application process quick and easy

Our industry-leading online portal makes it easy for agents to submit applications, and its built-in data often enables quotes in minutes. If a covered loss occurs, our dedicated claims team has the expertise to resolve it promptly and fairly.

Availability

- Massachusetts

- Florida

- Texas

** Additional states coming soon **

Coverage

- Up to $1.5 million of Coverage A (varies by state)

- Liability up to $1 million

- Wide range of deductible options

- Optional flood coverage available

Eligibility

- Single-family primary, secondary or rental homes

- Some age restrictions may apply

- Ability to cover properties in the name of an LLC or trust

Partners integrating MSI’s tech platform

Why MSI?

Why MSI?

Contact Us

"*" indicates required fields